Oxygen - of all the things we put in our bodies, it is by far the most important. If it weren't for oxygen, we'd cease to exist. It's definitely a good thing, then, that we can find oxygen all around us. Oxygen fuels our cells and gives our bodies the basic building blocks we need to survive. It helps us heal, and when we're stressed, taking a few deep breaths can help us calm down. But did you know the oxygen you're breathing right now is only about 21% pure?

That begs the question: What if we could breathe air that has 100% pure oxygen? As it turns out, Better Life Carolinas provides exactly that with our hyperbaric oxygen therapy (HBOT). And while the name sounds like something out of a sci-fi movie, the technology and benefits are real.

What is Hyperbaric Oxygen Therapy?

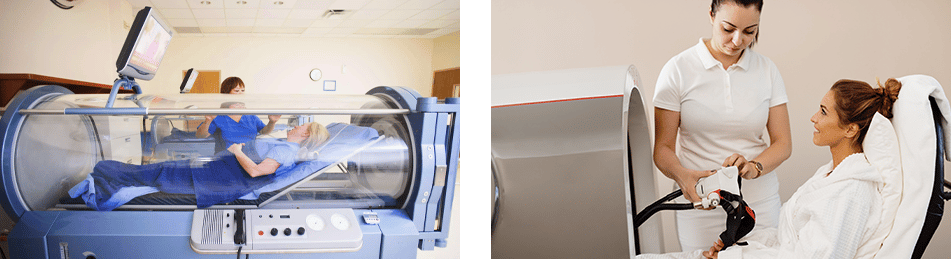

A wise person once said that oxygen under pressure equates to pure health. In some ways, that explains hyperbaric oxygen therapy in a nutshell. Hyperbaric oxygen therapy (HBOT) or hyperbaric chamber therapy is a revolutionary treatment where a patient relaxes in a comfortable chamber filled with 100% pure oxygen.

HBOT was initially used early in the 1900s and was later used in the U.S. to treat decompression sickness, which affects scuba divers. Today, hyperbaric chamber therapy is used by people from all walks of life, from businesspeople and athletes to blue-collar workers and stay-at-home moms.

During HBOT, the air pressure in the hyperbaric chamber is ramped up two or three times higher than typical air pressure. This increased pressure allows your body and lungs to absorb and gather higher amounts of pure oxygen - much more than you would be able to inhale, even if you were breathing pure oxygen.

How Does Hyperbaric Chamber Therapy Work?

If you're looking for an effective, efficient alternative to invasive procedures or heavy pharmaceutical medications, using a hyperbaric chamber in Nexton, SC is worth considering. Over the last few years, HBOT has exploded in popularity. More and more people are choosing to use hyperbaric chambers for certain conditions and ailments because they don't require surgery and have no serious side effects.

During hyperbaric therapy treatment, air pressure in the chamber is ramped up so that it is many times higher than ambient air. This increased pressure compresses the breathable oxygen inside the hyperbaric chamber, which you breathe into your body by way of your lungs and skin. The air is then circulated throughout your body via your own bloodstream.

When this pure oxygen is distributed in your body, it saturates your organs, tissues, blood, and spinal cord fluid. It even settles into areas of your body where circulation may be poor or blocked. Like powerful jumper cables, this potent oxygen jump-starts your body's cellular regeneration processes, significantly decreasing harmful inflammation.

This increase in pure oxygen and decrease in inflammation is used to treat many different types of conditions and illnesses, including:

- Sports Injuries and Recovery

- Strokes

- Anti-Aging

- Asthma

- Inflammation

- Allergies

- Traumatic Brain Injuries

- Erectile Dysfunction

- Plastic Surgery

- Cancer

- Diabetes

- COVID-19

- Stem Cell Generation

- Mold Exposure/Toxicity

What Conditions Does a Hyperbaric Chamber in Nexton, SC Treat?

Hyperbaric Chamber Therapy for Sports Injuries

When it comes to common uses for hyperbaric chambers, treatment for sports-related injuries is near the top of the list. Trusted by athletes of all persuasions across multiple sports, hyperbaric chamber therapy has helped countless men and women recover from common issues like fractures, sprains, and compartment syndrome. In fact, studies show that hyperbaric therapy for athletes may work just as effectively as traditional therapy when used as part of a recovery program to achieve the highest healing potential.

That's because competition, training, and recovery go hand in hand. To help with the rigors of high-level sports, HBOT oxygenates muscles, boosts immune systems, and speeds up recovery time for injuries. HBOT cuts down on recovery time by boosting your body's self-healing processes. That, in turn, promotes cell regeneration, which helps encourage tissues and muscles to mend organically, lessening scarring.

Hyperbaric Chamber Therapy for Stroke Victims

When a person has a stroke, blood flow to their brain is disrupted, most often by a major artery blockage. This causes a lack of blood flow, which manifests very quickly, and results in dead brain tissue or hypoxia. When untreated, the blocked artery causes a litany of damage which usually gets worse over time.

While it's impossible to say how much salvageable tissue is lost in the time after a stroke, hyperbaric chamber therapy may help boost cell reproduction and provide oxygen to tissue that died due to lack of blood flow. The non-functioning cells around the damaged tissue area cause much of a person's post-stroke issues. If HBOT can help bring life back to dead cells, the stroke victim could regain lost functionality.

Over the years, many studies have shown promising results when patients use hyperbaric chambers for stroke recovery. In fact, a study conducted in 2013 by Tel Aviv University's Dr. Shai Efrati showed without a doubt that high oxygen levels can awaken dormant neurons. After a two-month period of HBOT for two hours a day, five times a week, brain imaging showed a significant increase in neuronal activity in patients compared to periods of non-treatment.

Patients in this study reported better sensation, less paralysis, and more ability to speak.

Hyperbaric Chamber Therapy for Anti-Aging

Hyperbaric chamber therapy has been used for years by skincare clinicians to supplement common procedures. The results are often stunning and have been shown to help patients with the following:

- Rejuvenated skin

- Improved skin elasticity

- Skin texture repair

- Scar removal

- Fine line and wrinkle reduction

- Improved skin complexion

But how does a hyperbaric chamber in Nexton, SC kick-start skin rejuvenation? When oxygen levels in your body drop as you age, your body's healing ability slowly declines, resulting in less tissue function, damaged tissue, cracked skin, slow-healing wounds, and wrinkles.

The pressurized oxygen used in HBOT sessions can reach tissue at the cellular level to improve stem-cell growth, immune system defenses, and circulation while reducing inflammation. This process can have a powerful detoxification effect on your body. When toxins are removed, skin blemishes and discolorations are often removed, too, leaving your skin healthy and rejuvenated.

Hyperbaric Chamber Therapy After Plastic Surgery

They say that without pain, there is no gain, and that's typically true with plastic surgery and other cosmetic procedures. However, studies show that HBOT can help alleviate pain and boost recovery after plastic surgeries.

With normal levels of oxygen in the body, plastic surgery healing times can be lengthy and painful. Because hyperbaric chamber treatments expose your body to pure oxygen, recovery time is often reduced, and the healing process is accelerated - by as much as 75% in some instances.

The benefits of hyperbaric chamber therapy, when used for plastic surgery recovery, are numerous and include:

- Less need for post-procedure narcotic medications for pain

- Improved healing and recovery time

- Improved scar healing

- Less overall pain and downtime, allowing patients to return to normal day-to-day life sooner

A few plastic surgery procedures that HBOT can help with include facelifts, liposuction, mommy makeovers, breast augmentations, and even rhinoplasties.

Hyperbaric Chamber Therapy for Traumatic Brain Injuries

It's hard to fathom how much pain and PTSD a person goes through when they suffer from a traumatic brain injury. Serious head injuries don't just affect the recipient of the injury - they impact the patient's family, friends, and co-workers. Being able to treat people with serious concussions, TBIs, and other life-changing conditions like strokes is one of the main reasons we do what we do at Better Life Carolinas.

Mild TBIs usually require emergency care, medication, and extensive rest. But severe brain injuries require comprehensive medical interventions and post-care initiatives like speech therapy and physical therapy. The good news is that using a hyperbaric chamber in Nexton, SC as part of a comprehensive medical strategy may provide natural brain healing in TBI patients.

Hyperbaric chamber treatment's primary use in these cases is to hyper-oxygenate tissues, which helps dissolve oxygen in the plasma. This action triggers several healing processes without overwhelming the patient's antioxidant system. The working mechanism of oxygen under pressure can help improve cerebral blood flow through micro-vessels and target injured areas in order to decrease inflammation.

This promising anti-inflammatory effect is the primary advantage of HBOT for traumatic brain injury patients and clears the way for natural, non-invasive healing.

Hyperbaric chamber therapy has also been documented to help TBI sufferers in many other ways, including:

- Reducing neuroinflammation and cerebral edema

- Increasing the amount of oxygen saturation in the brain

- Increasing stem cell production in brain cells

- Repairing gray matter containing nerve cells

- Repairing white matter which connects cell bodies and carries messages between nerves

- Stimulation of immune system

- Provide oxygen to deficient areas of the brain, reactivating neurons

Hyperbaric Chamber Therapy for Erectile Dysfunction

As it turns out, using a hyperbaric chamber in Nexton, SC may have benefits in the bedroom, too. Studies show that men suffering from ED may now have an additional treatment option to reclaim their sex lives. The International Journal of Impotence Research published a study in 2018 to determine if HBOT was a viable, non-surgical treatment for erectile dysfunction.

The results were very positive and showed that erectile function improved by as much as 88% in patients. Subsequent MRI scans analyzing blood flow of the penis also showed dramatic improvement. The study concluded that, even after years of ED, men could experience benefits from using hyperbaric chambers in lieu of risky surgeries and ineffective ED meds.

The documented improvements were due to more angiogenesis or growth of blood vessels in the penis. When new blood vessels grow in the penis, they can carry more blood to the organ, which helps achieve more frequent, stronger erections.

FAQHyperbaric Chamber FAQs

Though hyperbaric chambers are getting more popular with everyone from athletes to office workers, some folks are still out of the loop. If you're interested in learning more about this exciting, non-invasive, natural treatment, we encourage you to contact Better Life Carolinas today. Until we hear from you, here are answers to some of the most common questions we get regarding hyperbaric chamber therapy.

I'm interested in hyperbaric chamber therapy. What does it feel like?

AWhen your session begins, oxygen will immediately circulate throughout the chamber, and pressure will gradually increase. At this point, most patients start feeling a fullness sensation in their ears, like they're ascending or descending in a plane. This feeling only lasts for 10-15 minutes. An experienced Better Life Carolinas hyperbaric technician will guide you on how to relieve any ear pressure, if necessary. Once the optimal pressure is reached, all you have to do is relax and breathe normally. As the session ends, your hyperbaric technician will gradually lower chamber pressure, which lasts about 10 minutes. During this stage, you may experience a light popping sensation in your ears. Once pressure is back to normal, you can exit the chamber and go about your day.

Should I be worried about any side effects from a hyperbaric chamber?

AIn general, you don't have to worry about serious side effects from HBOT. That's because it's an all-natural treatment - there are no incisions or addictive medications involved. However, some patients experience mild ear drum irritation. During your session, a Better Life Carolinas hyperbaric chamber expert will be by your side to help prevent this from happening.

How many hyperbaric chamber sessions will I need?

AWithout a proper evaluation of your unique needs, it's hard to say with certainty. At Better Life Carolinas, we know that every patient is different. As such, every recommended therapy will be different, including the number of hyperbaric therapy sessions you need. Generally speaking, patients usually require 30 to 40 sessions. HBOT has a cumulative effect on your body and, as such, provides the best results with regularly occurring sessions.

Is there anybody who should avoid hyperbaric chamber treatments?

AIf you have a form of air-trapping emphysema like COPD or have an untreated pneumothorax, HBOT isn't for you. At Better Life Carolinas, every one of our patients undergoes a full evaluation to ensure that hyperbaric oxygen therapy is safe for you and your body.

Unlock the "New You" with Hyperbaric Chamber Therapy from Better Life Carolinas

If you're looking for a hyperbaric chamber in Nexton, SC look no further than Better Life Carolinas. Whether you're a professional athlete looking to maximize recovery time or need a natural way to look and feel younger, our experts are here to help. Unlike some clinics that rely on major invasive procedures and addictive medications, our team focuses on natural, holistic ways to heal your body. If you're ready to optimize your health and reclaim your youth, contact us today to learn more about HBOT and our other natural therapies.

Free Consultation

Copyright 2024 by Dr. Mickey Barber's Better Life

843-737-2597

843-737-2597